heloc draw period repayment calculator

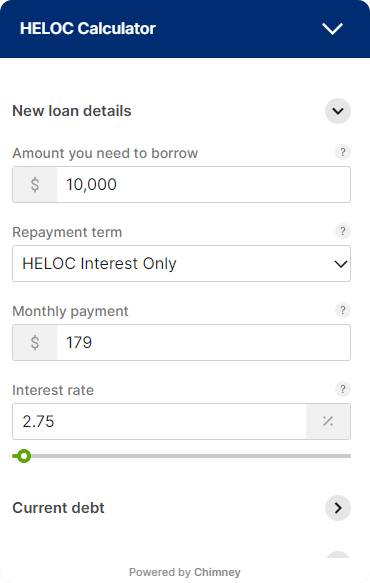

The third column can be thought of as the draw period on a HELOC where the homeowner is making the minimum monthly payment. Fixed-Rate Loan Option monthly minimum payments The minimum amount you will need to pay each month on your home equity line of credit Fixed-Rate Loan Option.

Home Equity Line Of Credit Heloc Rocket Mortgage

To access a HELOC you need to have the corresponding equity available in your property.

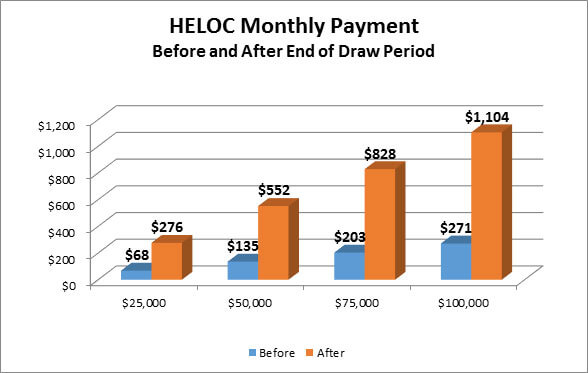

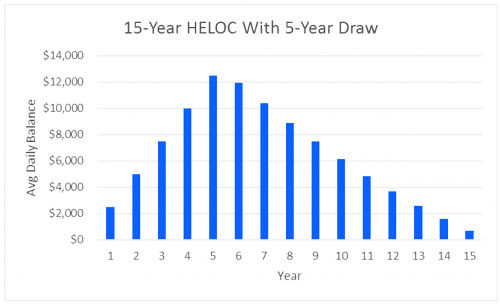

. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment for a loan term of 15 years. At the end of your loan term you can no longer withdraw funds and the balance of the loan becomes due. The balance of a home equity line of credit payment could change from day to day depending on the draw length and repayments.

A draw period during which you can borrow against the line of credit as you wish and a repayment period during which you. Age of the loan. HELOCs typically have a draw period of up to 10 years and a repayment period of up to 15 years beyond the draw period.

HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments. This Page Was Last Updated. Home Equity Line of Credit HELOC Calculator 2022.

A HELOC has two phases. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. It works like any other credit card where you can make everyday purchases and earn unlimited 15 cash back.

A HELOC has two phases known as the draw period and the repayment period. With this information the builder can determine the amount of materials needed and design the ramp. 25000 to 1 million.

A Home Equity Line of Credit HELOC is a line of credit you can access for a variety of things. You will need the following statistics to get started. Your HELOC draw period is the length of time you have to draw funds from your HELOC loan.

Home Equity Line of Credit Calculator. Then comes the repayment period when. You can draw from and pay back into it whenever you want.

In a home equity line of credit the repayment period is the portion of the loan term that follows the draw period. Wheelchair ramps are commonly built of wood cement or metal. How a Home Equity Line of Credit Works.

When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting the cash you need. Generally HELOCs come with a repayment period between 10 20 years attached. You have the option to choose a minimum monthly payment of 1 or 2 of your outstanding balance though some may qualify to make interest-only.

During your 10-year draw period you can borrow as little or as much as you need up to your approved credit line. There is however no grace period where you wont be charged interest until a certain date the moment you withdraw from the HELOC interest starts accruing. Your payments are determined by.

Cash Out draw to bank account fee and Balance Transfer fee is 2 of amount transferred. Best for Low Fees. Total Weight of Car with the driver included 3.

It is usually a fixed amount of time but each draw time varies between lenders. A home equity line of credit is a revolving line of credit. During the draw period you borrow money as needed and required monthly payments generally just.

Compared to mortgages. First is the draw period during which you borrow money and make payments against the interest. The bank opens a credit line for you and the equity in your home guarantees the loan.

Even after the Tax Cuts and Jobs Act of 2017 you can still deduct interest paid on a home equity line of credit or home equity loan if you use the money for home improvements. Following the draw periods expiration the repayment period begins. The interest-only repayment option is an attractive feature of a HELOC.

Important HELOC factors to consider. Calculator Pros 14 Mile Calculator requires a few sets of data in order to compute your cars quarter-mile elapsed time. Whereas during the repayment period the monthly payment can jump to 330 if it is over 20.

HELOCs have two parts. A HELOC draw period is the. The term of a home equity line of credit can be as little as 5 or as much as 10 years.

A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans Footnote 1 such as credit cards. A 15-year HELOC with a 20000 limit at five percent interest will require a payment of 160 per month. 15000 to 750000 1 million in California Up to 90 can be waived 10 years.

However if you have a ten-year draw period that means your repayment period is just five. Try our HELOC calculator or request an instant offer today. This is often stated as a 1 in 12 slope and is considered a standard in accessibility ramps.

That is the value of equity in your home that you currently own must be higher than the. For example on a 50000 HELOC with a 5 interest rate the payment during the draw period is 208. At this point you start paying back the amount of the remaining principal you owe plus interest.

During your repayment period youll no longer have access to funds via the HELOC and will be required to make monthly payments until the loan is fully paid off. It is important to understand that the payment during the repayment period can be significantly higher than the draw period. The Repayment Period.

A HELOC often has a lower interest rate than some other common types of loans and the interest may be tax deductible. All borrowed funds are secured by the value of the equity in your home. As soon as the draw period ends the repayment period commences.

A home equity line of credit is the most flexible type of home financing available. A home equity line of credit HELOC is a type of revolving credit that allows you to borrow against the equity in your home. You will see a drop-down box at the top of the calculator that has constants already.

Up to 99 can be waived 10 years. This makes a home equity line of credit another good option for making large purchases. The repayment period typically lasts 20 years.

The lengths of your draw period and repayment period will be specified in the HELOC loan agreement. The repayment period can be either fixed or adjustable rate. Interest rates on HELOCs are often variable tied to published market rates and currently range from a low of 25 to as much as 21.

Aven combines the convenience of a credit card with the savings of a home equity line of credit HELOC. HELOC Amounts Annual Fees Draw Period Repayment Period. Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower.

The rate youre offered will depend on your credit scores income. The calculator bases the results on a slope of 1 vertical inch for each 12 horizontal inches. As a revolving line of credit you can borrow up to a certain amount and make monthly payments on the amount youve borrowed.

It can also display one additional line based on any value you wish to enter. During the repayment period your minimum monthly payment will be an amount necessary to repay the outstanding balance over the.

Heloc Calculator How Much You Can Borrow Casaplorer

Heloc Payment Calculator With Interest Only And Pi Calculations

How To Calculate Equity In Your Home Nextadvisor With Time

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union

How To Get The Best Heloc Rates Zillow

Looking For A Heloc Calculator

Heloc Payment Calculator With Interest Only And Pi Calculations Home Equity Loan Home Improvement Loans Heloc

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Qualification Calculator

What Underwriters Look At Heloc Requirements And Eligibility Pointers

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Macu